How are China Tariffs Affecting Pricing in the American Automotive Aftermarket?

As part of his strategy against the Chinese “Made in China 2025” industrial policy, In July 2018 the Trump Administration placed $34 billion in tariffs on goods coming from China, prompting the Asian powerhouse to retaliate with an equal amount of tariffs on American imports. The rationale was to stop China from stealing Intellectual Property and manipulating currency. China has been known to counterfeit famous brands, steal trade secrets, and pressure companies to share technology with Chinese companies to gain access to their vast market. Multiple rounds of tit-for-tat tariffs have led the US to put taxes on $360 billion of Chinese imports. China, the largest trading partner of the US, has responded with tariffs on $110 billion of US goods.

To be clear, these tariffs are essentially taxes that the IMPORTING COMPANY pays (not China, as many erroneously believe). In the US, tariffs are collected when Chinese products enter port cities. They are paid by the US-based companies which receive the goods. The notion was not to tax China, but to have taxed US importers choose to import less from China and greatly reduced US demand. So far, however, demand has remained fairly consistent with pre-tariff numbers. Tariffs at both points of the supply chain (in the United States and in China) run the risk of cost inflation for companies which have manufacturing units in either country, which if unchecked will eventually lead to an escalation in costs across many other countries as well.

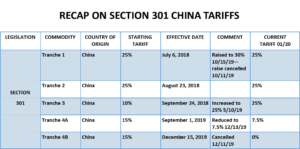

Some of the US tariffs started at 10% and later went to 25%. Some started at 25% and stayed there. If the idea was to create uncertainty for China, that was accomplished, but the uncertainty was even more acutely felt by the US companies who were paying the tariffs. In either event, as of right now nearly every item imported from China is subject to a 15 or 25% tariff EXCEPT consumer goods (sneakers, tech items), which were saved from tariffs just days before they were set to be implemented in December 2019.

Nearly all automotive tools and components are imported from China, and so the automotive aftermarket has been hit particularly hard by the tariffs and their associated uncertainties. This is part of the reason Democrats and Republicans alike have supported the new NAFTA deal with Mexico and Canada (USMCA) to divert from China.

Because things have been erratic for automotive aftermarket importers in 2018 and 2019 it has been extremely difficult to plan. Tariffs have been announced, only to be cancelled. Set, only to be raised, or lowered. (See graphic below for history). Most importers hoped the tariffs would be short-lived and did not pass along the 15-25% additional cost of goods to their customers in 2018 and 2019. However, despite the recent announcement of a “preliminary trade deal”, it’s now clear these tariffs will be long-term. Companies which have been bearing the burden for the past year and a half are expected to pass the cost of the tariffs onto their customers – and ultimately onto consumers—in 2020 in order to stay in business. That means rising prices.

We are happy to report that at FJC we have been monitoring these tariffs since before they began. We have painstakingly planned, out-sourced, purchased in bulk, moved production, and negotiated to minimize the impact on our customers. The result? For 2020 FJC customers will not see a noticeable change in the cost of their FJC purchases. Some products will see modest increases, others will remained unchanged, and yet others will see modest decreases. This is just one of the many ways we work hard to show our customers that we care and value their business.

LMK 2020